Inflation and a Likely Recession; the Return of the Old Maladie

The Blog Papers of Dr.

Michael Sakbani; Economics, Finance and Politics

Dr.

Michael Sakbani is a professor of economics and Finance at the Geneva campus of

Webster-Europe. He is a senior international consultant to the UN system,

European Union and Swiss banks. His career began at the State university of NY

at Stoney Brook, then the Federal Reserve Bank of New York followed by UNCTAD

where he was Director of the divisions of Economic Cooperation,

Poverty Alleviation, and UNCTAD`s Special Programs. Published over 125

professional papersand coaurhored 6 books. The Intelligent Economist selected Dr. Sakbani`s blog michaelsakbani.blogspot.com

as one of the top 100 blogs in the world in 2020, and 2022.

- Getting Peace in Time of Peril

- A Plan For Ending the War in Ukraine

- Prleliminary oulineof a ukraine

solutionByDr. mic...

- Why did the Syrian Revolution Fail

- Democracy in the USA; a critical evaluation

- The Middle East and the New Sham

Project; Fantaci...

- President Biden`s Fiscal Policies In The

US`Curren...

- Post - Trump America: A Clarion Call For

Reconstru...

- The 2020 Elections In The Collimator;; What

Did Th...

- President Trump and a Possible Biden`s Victory

in ...

SATURDAY, NOVEMBER 12, 2022

Inflation

and a Likely Recession; the Return of an Old Malady

Inflation and

a Likely Recession ; the Return of an Old Malady

by

Dr. Michael Sakbani

The things we

forgot

Over the past

four decades, the world has forgotten about the old malady: inflation. That is

because China and other developing countries learned how to export and attract

developed country profit- seeking enterprises to locate therein in order

to produce products at lower costs. The advantage of low cost was due to

cheap labor as well as escaping international labor, environmental and

public-health standards. This great transfer of jobs built an efficient global

supply- chain. It brought down consumer prices, vastly increased company

profits, created international economic dependence and equally plighted many

old industrial areas in the US and Europe. The globalization of supply escaped

national state control and the resultant uncontrolled international business

greatly favored globalization participants and markedly contributed to severe

income inequalities. This was globalization as we experienced it for the three

decades since the nineties.

The

industrial globalization was also followed by a similar financial globalization

which brought to the whole world the recession of 2008. The public treasuries

paid out billions to save the financial system which caused the recession. And

ironically, the financial system rewarded the guilty doers who scandalously

escaped any accountability.

In this

apparent, but surface well-being, Central Banks did very well their job of keeping the economies growing but hardly thought about the impact of

their quantitative expansion on their job of guarding against future inflation.

And when the time came to act, they acted late, but with vengeance.

In 2019, the

world was hit by COVID, an extraordinary global epidemy. Nobody seemed to have

been well-prepared for this global event. In the world leading economies:

the USA and China, the reaction differed. In China the remedy was a

lock-down to achieve zero covid and in the US, President Trump was more

interested in his reelection than in combatting the epidemy. The global

aggregate supply and demand were simultaneously destroyed and a far reaching

slump took hold with massive labor furloughs and pent- up demand, especially

for services.

At the end of

2020 and throughout 2021, global expansionary fiscal policies were vigorously

pursued with accommodative monetary policies in almost all the developed

economies. These policies protected the economic well-being of the public,

saved many jobs from disappearing and kept small and medium businesses out of

bankruptcy. In 2022, most economies were recovering from the devastation of

COVID 2019. But the recovery was asymmetrical, being largely on the aggregate

demand side, while the aggregate supply side was hampered by supply-chain

dislocations that included China`s zero-covid policy, bottlenecks in the structure

of supply chain as well as shifts in planned business investments.

All of that resulted in a skewed recovery: recovery in aggregate demand but

a hampered one in aggregate supply.

Adding to

this, President Putin unclenched in February 2022 his attack on Ukraine. The US

lead the West in imposing draconian all-encompassing sanctions on the Russian

economy to cut its exports. So far, the

sanctions have resulted in harming the

Western economies and increasing President Putin oil and gas revenuesby more

than $100 billion despite a 20 percent

reduction in his sales of oil and gas. The war shot- off also 30 percent

of the global supply of wheat and fertilizers and the bulk of Russia `s supply

of gas and oil to Western Europe.

Inflation: a

Statistical Picture:

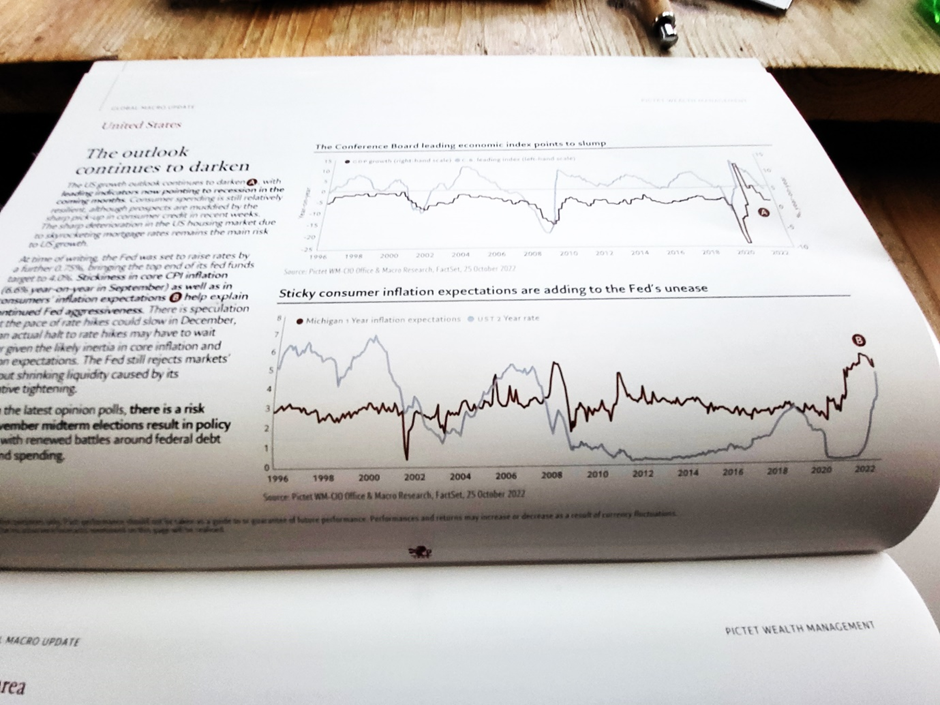

Figure one USA

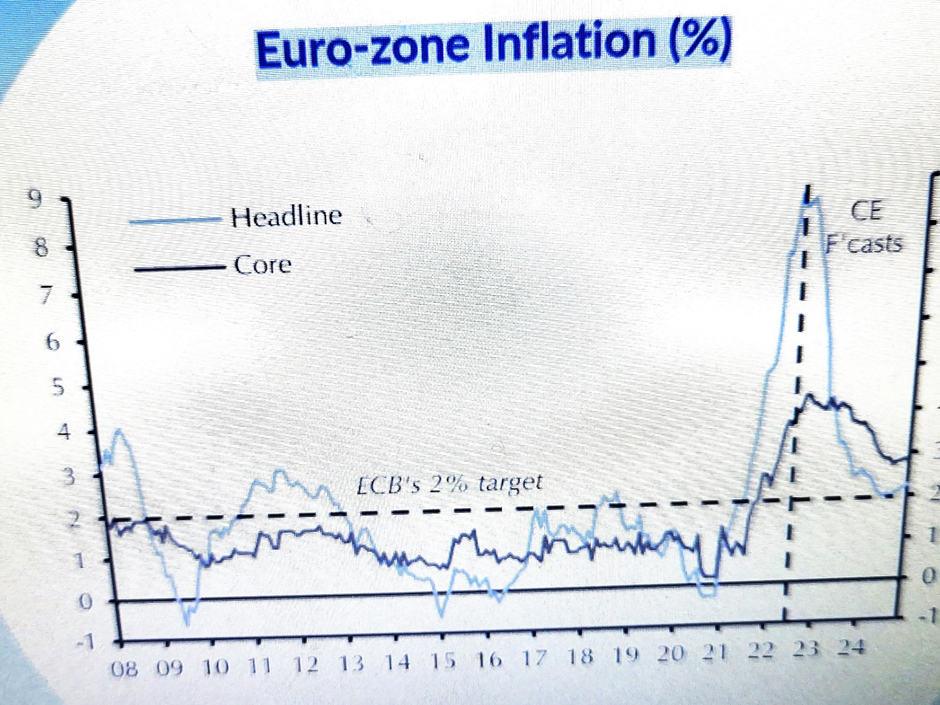

Euro- area inflation

Figure

three

Global Inflation

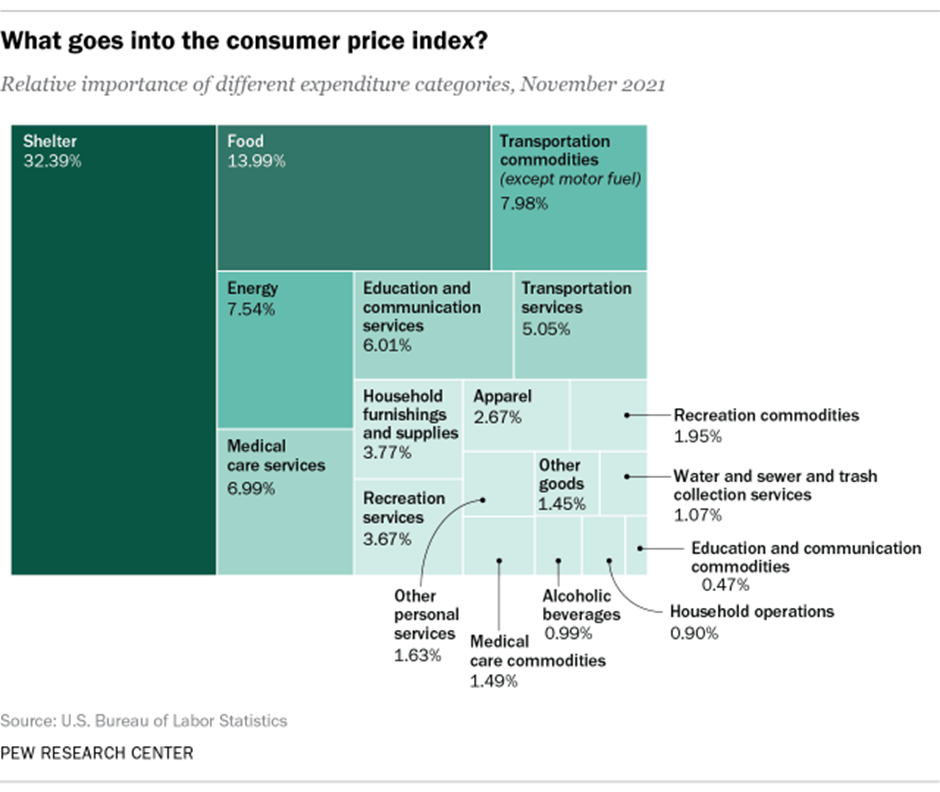

Second, the

composition of inflation is wide ranging covering, energy, transportation

costs, food, fertilizers, consumer credit, borrowing cost and housing mortgage

rates. Thus, it is quite comprehensive and by the consequent interactions is

self- sustaining.

Table 1

Composition of inflation

PEW RESEARCH CENTERJANUARY 21, 2022

What goes into the consumer price index?

Third, many developing countries face physical shortages in aggregate supply, while developed countries face, on the whole, bottlenecks in the aggregate supply.

Fourth, the prices of the major components of inflation; namely, food, energy and fertilizers are determined in the international market and not in the local markets. Hence, international traders such as the oil companies stand to reap windful profits, quite unearned by their local operations, because of this off-limits revaluation of their inventories. Indeed, the data in table 2 show historical records of profits of all US`oil and energy companies.

Table 2

The

windful profits US oil companies

Oil company profits: Net income (excluding exceptionals) $bnJan - Sep 2021

Jan - Sep 2022

reported

Forecast

$0bn

10

20

30

40

Shell

$12.8bn

$30.1bn

BP

8.7

20.7

ExxonMobil

14.3

42.7

Chevron

10.7

27.3

TotalEnergies

11.3

28.7

Eni

2.6

10.3

ConocoPhillips

5

13.8

Guardian graphic.

Source: S&P

Global Market Intelligence; Guardian Analysis

Inflation

Causes; Real and Financial

There are

real and financial causes for the present inflation. The real factors are

headed by the Covid 19 epidemy, which wiped out aggregate supply from

February 2020 till the wide roll- out of the vaccines in the spring of 2021,

close to 16 months of large-scale closures. This destruction of aggregate

supply was global. Hence, the global supply- chain which has been built and

widely scattered in the heydays of globalization was very affected. China,

which accounts for about one fourth of world exports and dominated the supply-

chain pursued a policy of zero covid which meant continued closure of its

productive factories when the Western economies were beginning to recover.

To this list

of aggregate supply problems, President Putin added an ace: he unclenched in

February 2022, his attack on Ukraine. The war and the Western

unified reaction to it, resulted in severe energy shortages, especially

in Europe; oil prices nearly doubled and gas prices increased four folds.

The situation is dissimilar in the US, because while the country is

self-sufficient in energy supply, it is deficient in refining capacity. The US

energy companies using off-limit international pricing did not cap their prices and reaped the huge

windful profits shown in table 2.

It should be recalled that Russia and Ukraine are in the top five global exporters of food, commodities and fertilizers.,The two of them account for 30 percent of wheat exports. Ukrain, by itsself has 10 % of the world market in wheat, 15 % of corn and 13% of barley (Eisele/DW)[i]The interruption of these exports caused price increases everywhere. This price escalation masked the significant decline in global commodity prices in 2022.

The financial

causes were precisely the vigorous fiscal policies pursued by all countries and

the accommodative monetary policies accompanying them. In the USA, fiscal

measures during President Trump`s term and the first two years of

President Biden added $ 5.5 trillion to planned expenditures over several

years. About half of that was pumped into circulation over two and a half

years; a massive and unprecedented monetary stimulus.

President

Biden`s budget stipulated raising taxes to finance one third of his

expenditures, and assumed a growth scenario of the economy, and thus of tax

revenues, to finance a second third. In reality however, the proposed tax

increases failed to pass the US` Senate and the supply problems did not allow

the forecast growth in revenues. Hence, the excess supply of money was not

about $800 billion , rather the entire amount pumped in in the last two

years, i.e. three timesas much.

The Evolution

of Inflation in the US, Japan and Europe

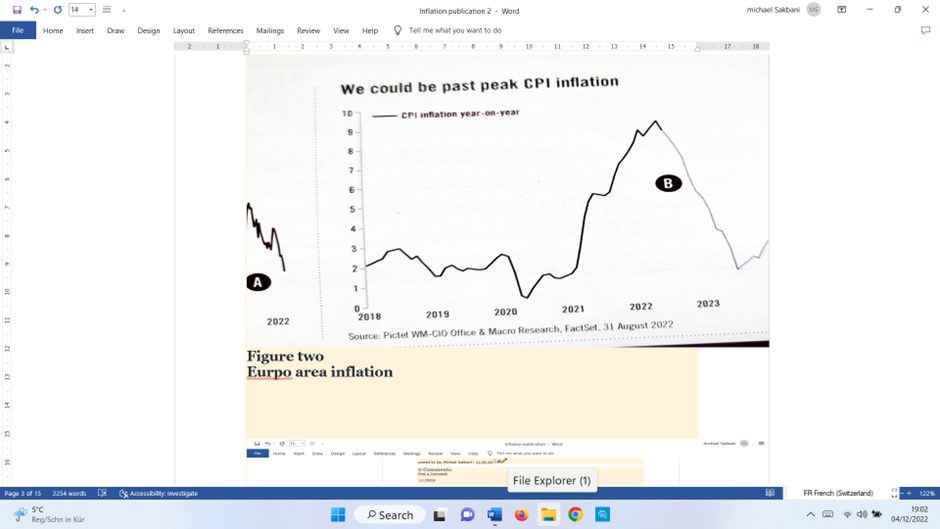

figure 4

Diagram of US inflation pace

figure 4 shows that the US` CPI (consumer price index) attained the highest level in the past forty years. It rose from 2.2 percent in 2016 to 9.2 percent last August. Thereafter it has declined in September and October to 8.6 percent. The forecast is for a more slow decline in the months ahead. The most notable inflationary parts of the CPI basket are food, borrowing cost, and mortgage rates. Energy prices have declined for several months through September and have levelled off thereafter.

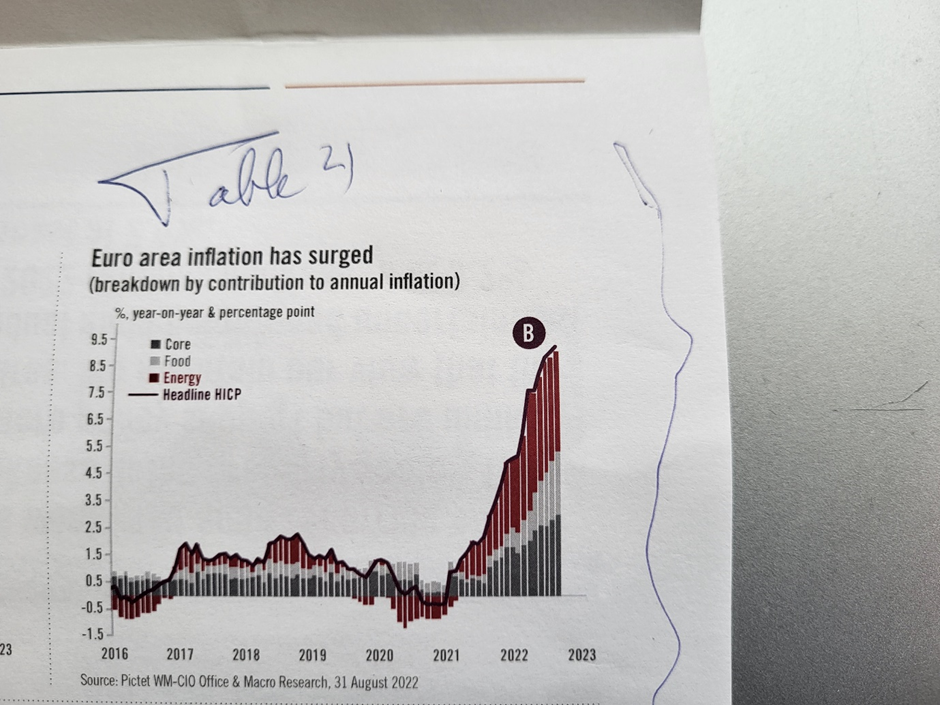

In the Euro area, the picture as shown in figure 5 is even worse. Inflation has risen from virtually zero in 2016 to 9.5 in October 2022 and a consensus forecast of 10 percent early in 2023. Energy remains the biggest contributors to the index` basket.

Figure Five

EU inflation pace

The UK

provides the grimmest picture with inflation climbing to 11.1 in November 2022

from 10.1 in October. Both food and energy are the biggest contributors. it is

now officially recognized that the UK economy is already in recession (Pictet

Banque, September 2022, )[ii]

Japan is an

outlier in that its inflation rate went up from - 0 .4 percent in 2012 to 2.9

percent in September 2022 (Ibid,) [iii].

The US

‘Policy Response and the likely Recession

The US

‘policy response is in many ways similar to the policy responses of other

developed economies, with the possible exception of the UK. It stays its hands

on fiscal policy but assigns to monetary policy the task of wrenching out inflation.

Monetary

policy impacts directly aggregate demand with a lag of that extends to 9 months. It

affects aggregate supply only indirectly and after a more extended lag.

The US` Federal Reserve has so far raised its rate by four points in less than

a year. The question raised by financial commentators is whether the Fed will

refrain from further hikes once it reaches a plateau of 4.5 percent, which it

is expected to attain by the end of this year. A quantum jump of interest rate of 400 paces- points

has historically brought down recession.

The US

economy still faces a strong labor market with unemployment around 3.6

percent. the Biden Administration has added 10 million jobs to employment

through October 2022 and is expected to add more in November. This level of

unemployment is historically full employment. However, there are more job

offers than job seekers. Three factors might shed some light on this riddle. The participation of able white workers in the active labor force has declined in the

last three decades. Nobody has come up with a satisfactory explanation of that.

The second factor is the difficulties President Trump put on students and

foreign workers visas and immigration which has affected the Tech. Sector

in particular. The third factor is the decline in female participation in

active job seeking. Female participation rate has declined since the onslaught

of COVID 19. This is the case in minority female workers and low paying jobs

laborers. It is perhaps not surprising that the lack of public support in the

US for children care of working mothers is responsible for that.

This muddy and somewhat complex picture poses

difficulties for monetary policy making. The other major difficulty is

that aggregate supply is somewhat missing in this policy picture. There is

evidence that the supply-chain problem is easing. But China`s zero Covid policy

is still keeping China`s factories away from supplying the required accessories

and intermediate products.

Thus, the Fed

will have to continue pressing down aggregate demand to a level well below the

economy`s capacity in order to equal aggregate supply. This is indeed a

harbinger of recession in 2023. In this respect however, there are several

factors that should moderate the Fed`s action. The first one is the decline in

inflation pace shown in the figures above. It can be reasonably predicted that by mid-december the CPI would be around 7 percent and core iinflation bellow 5 percent. The second is the decline in

employment shown in the most recent data exhibited in table three bellow.

Table Three

US` Employment

Statistics

Employment Rate in the United States

decreased to 59.90 percent in November from 60 percent in October of

2022.

source: U.S. Bureau of Labor Statistics

|

Related |

Last |

Previous |

Unit |

Reference |

|

3.70 |

3.70 |

Percent |

Nov 2022 |

|

|

263.00 |

284.00 |

Thousand |

Nov 2022 |

|

|

158470.00 |

158608.00 |

Thousand |

Nov 2022 |

|

|

0.60 |

0.50 |

Percent |

Nov 2022 |

|

|

62.10 |

62.20 |

Percent |

Nov 2022 |

|

|

10334.00 |

10687.00 |

Thousand |

Oct 2022 |

|

|

1.20 |

1.30 |

Percent |

Sep 2022 |

|

|

59.90 |

60.00 |

Percent |

Nov 2022 |

|

|

26394.00 |

26230.00 |

Thousand |

Oct 2022 |

|

|

132228.00 |

132661.00 |

Thousand |

Oct 2022 |

---------------------------------------------------------

United States

Employment Rate

In United States, the employment rate measures the number of people who

have a job as a percentage of the working age population.

|

Actual |

Previous |

Highest |

Lowest |

Dates |

Unit |

Frequency |

||

|

59.90 |

60.00 |

64.70 |

51.30 |

1948 – 2022 |

Percent |

Monthly |

SA |

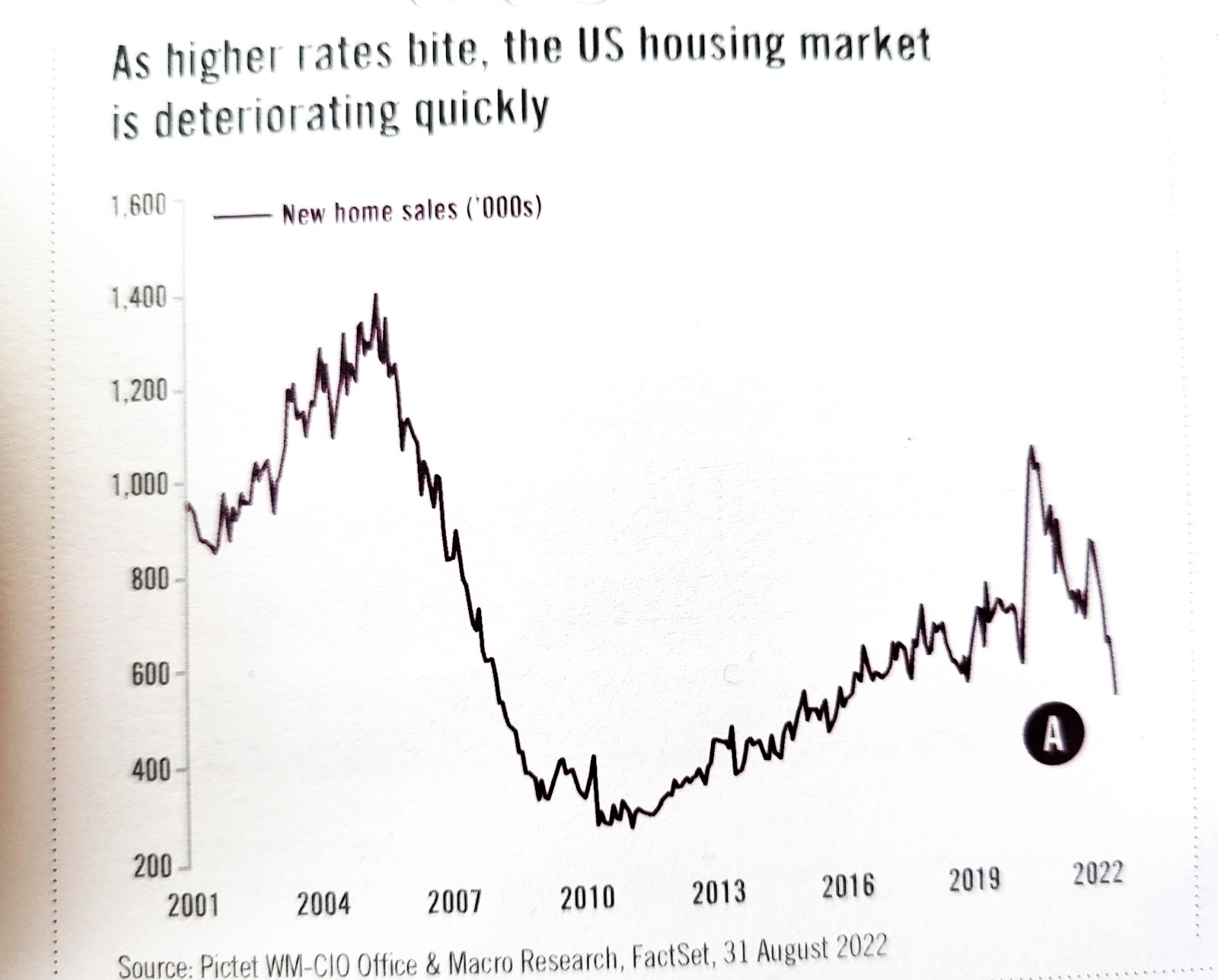

The third factor is the decline in aggregate demand.

There are many signs of that. One such an

indicator is the decline in business investment orders, a leading indicator.

The other one is the steep decline in new housing construction.Figure six bellow documents

this factor

Figure Six

Decline in New Housing Starts

The University of Michigan Survey

points to recession expectations of consumers. Moreover, job creation is

beginning to dip because real wages which were positive till March 2022 have turned negative thereafter. However, these three

factors are counteracted by the stickiness of consumer expectation shown in

figure seven bellow

Figure Seven

Stickiness of Consumer Expectation

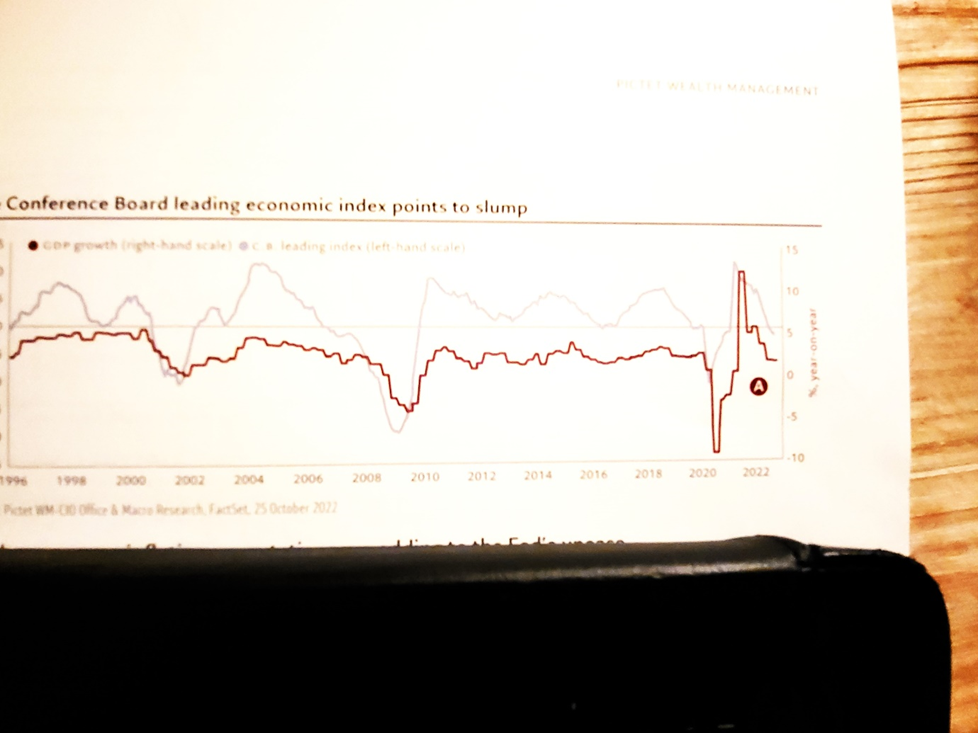

Nonetheless, the Conference Board tracking several leading indicators has concluded that the US will dip into a mild recession in 2023 (Author`s note)[iv].

Figure Eight

Conference Board Leading indicators

Geneva (Octobe2022)

Notes

[1] Ines Isele in DW, 11/1/2022

[ii]According to Bank Pictet WM CIO

Office & Macro Research, , fact set, September 29, 2022, the UK inflation rate of the CPI went up from

2 percent in 2002 to 11 percent. The

core inflation rate went up from 2 percent to 6.5 percent.

[iii] Pictet Bank OP. Cit.

[iv] The Peter Peterson Institute estimated that

the US Administration can shave off 1 percent of the CPI inflation rate by

cancelling President Trump import duties on China. President Biden indicated

that this step is under consideration.

Furthermore, the Inflation Control

Act of 2022, would cut off over 2023 the cost of drugs and health

care support by another 1 percent.

The US Bureau of Labor Statistics reported that US`

employment increased in November 2022 by 265 thousand,a figure

signinficantly larger than what was expected. Therefore, it looks that the US labor market

is still strong and the US economy might avoid a severe recession if the

Federal Reserve moderates its stance in light of all the data marshalled above..

posted by Dr. Michael Sakbani | 12:38 AM

0 Comments: